Introduction: The Political Landscape Ahead of 2024

As the United States approaches the 2024 Presidential elections, the political environment is more complex and charged than ever. One of the central figures in this landscape is former President Donald Trump, who has announced his candidacy for a second term. His return to the political arena carries significant implications for various demographics, particularly U.S. expatriates who are currently grappling with unique challenges regarding citizenship-based taxation.

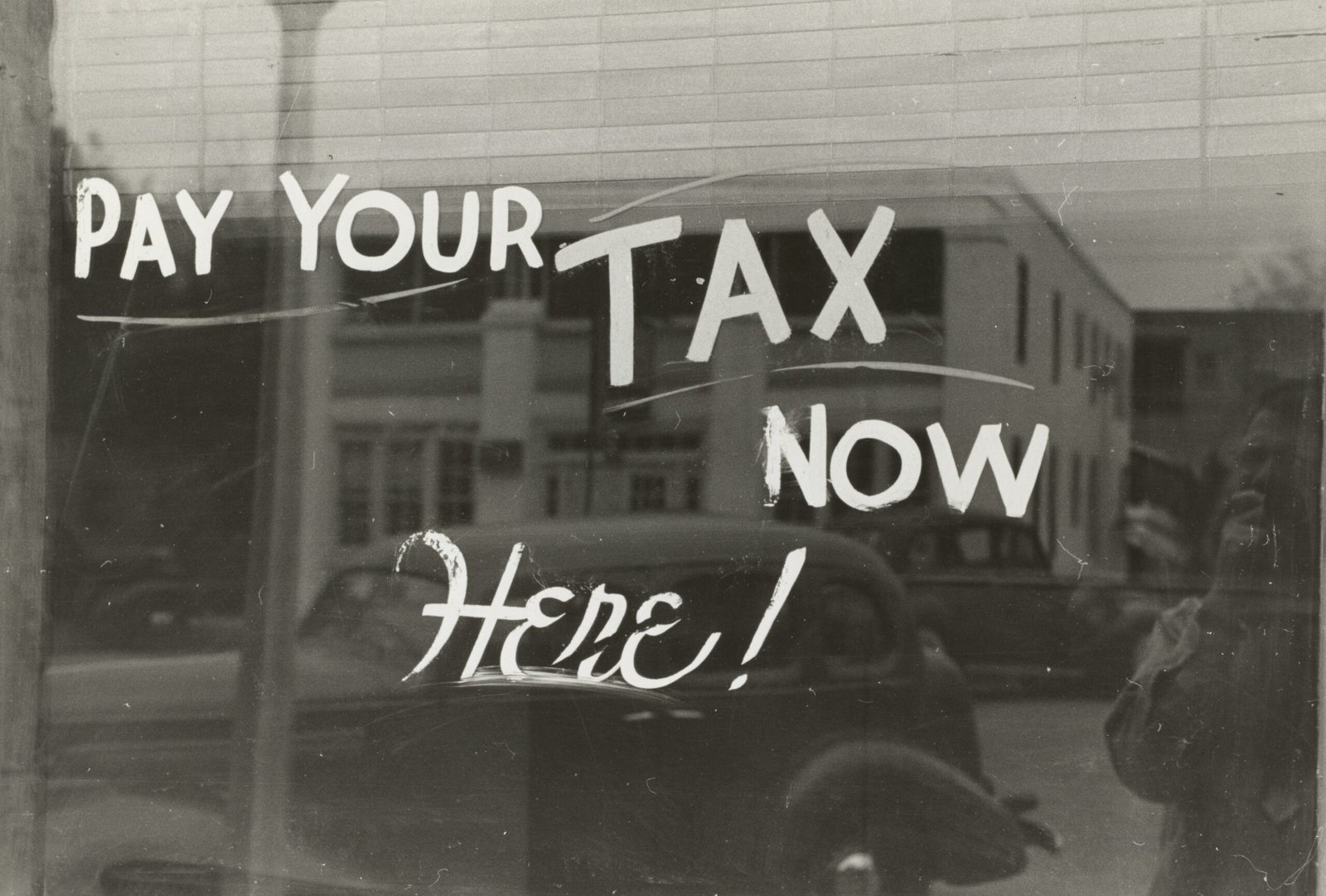

The concept of citizenship-based taxation, whereby U.S. citizens are required to pay taxes on their worldwide income irrespective of their residency, has been a contentious issue. Many expatriates face a double taxation dilemma, whereby they are taxed both by the United States and the country in which they reside. This situation has led to growing frustration among expatriates, who advocate for reforms that would alleviate the financial burdens imposed by such tax laws. The ramifications of Trump’s policies during his previous term, including the stringent enforcement of tax obligations for expatriates, are still fresh in the minds of those affected.

As various factors converge in the lead-up to the elections, it is crucial to assess how Trump’s administration, if reinstated, would address the concerns of expatriates vis-à-vis taxation. The Republican Party, under Trump’s influence, has shown a tendency to prioritize deregulation and favor policies that align with wealth accumulation for American individuals abroad. However, the former President’s policies may also exacerbate existing scrutiny on offshore accounts and foreign income, asserting the need for a broader discourse regarding these taxation policies.

The implications of his potential victory on U.S. expatriates can absolutely reshape their financial landscapes, making it imperative for expatriates to prepare and stay informed about the evolving political context as the 2024 elections approach.

Understanding Citizenship-Based Taxation

Citizenship-based taxation (CBT) is a unique feature of the U.S. tax system that requires all U.S. citizens, regardless of their residency status, to report and pay taxes on their worldwide income. This system contrasts sharply with most other countries, which implement residence-based taxation (RBT). Under RBT, individuals are taxed solely on income earned within the borders of that country, rather than on global income. The U.S. approach means that American citizens living abroad must navigate complex tax requirements that can create significant challenges.

The legal framework for CBT is established by the Internal Revenue Code (IRC), specifically in sections that mandate disclosure of foreign income and assets. U.S. citizens living overseas are required to file annual tax returns, even if they do not owe any taxes due to foreign earned income exclusions or credits. Alongside this, they must also contend with additional reporting requirements such as the Foreign Bank Account Report (FBAR) and Form 8938, which documents foreign financial assets. Failure to comply with these obligations can lead to severe penalties, making adherence essential for expatriates.

Moreover, CBT affects over nine million American expatriates who face double taxation issues when earning income in countries with different tax structures. For instance, many foreign nationals can benefit from different tax treaties and exemptions not available to U.S. citizens. As a result, U.S. expatriates often find themselves in a precarious position, compelled to manage tax responsibilities that can significantly impact their financial well-being and overall residency decisions. Consequently, understanding CBT and its compliance requirements is vital for U.S. citizens living abroad, particularly as shifts in political leadership may usher in substantial changes to existing tax policies and international relations.

Trump’s Tax Policy: A Review of Previous Actions

During his presidency, Donald Trump implemented several tax policies that had far-reaching impacts on U.S. citizens, including expatriates. His administration’s cornerstone legislation was the Tax Cuts and Jobs Act (TCJA), enacted in December 2017. This comprehensive tax reform aimed to lower the tax burden on American individuals and corporations alike, yet it also introduced complexities particularly relevant to expatriates. The TCJA lowered the corporate tax rate and offered tax cuts to many American families, but it also maintained the principle of citizenship-based taxation, which mandates that U.S. citizens living abroad must still file tax returns and pay taxes on their worldwide income.

One notable change under the TCJA was the increase in the foreign earned income exclusion (FEIE) limit. For expatriates, this increase allowed individuals to exempt a greater portion of their income from U.S. taxation, effectively providing some relief from double taxation. However, despite this increase, many expatriates found themselves still facing complexities due to the requirement to file multiple returns and navigate differing tax regulations between the U.S. and their host countries.

Additionally, Trump’s administration proposed a reduction in the estate tax, which would have significant implications for Americans moving abroad. Critics argued that this proposal would benefit wealthy expatriates, while those with lower incomes continued to face burdensome compliance requirements. Overall, the Trump administration’s approach exhibited a duality—offering some benefits while simultaneously reinforcing the challenges tied to citizenship-based taxation.

As the political landscape evolves, it is crucial to analyze Trump’s past actions and consider how they might influence future tax policy proposals. Understanding the historical context surrounding Trump’s tax reforms prepares expatriates and stakeholders alike for potential changes that may emanate from a second term, especially given the ongoing debate surrounding citizenship-based taxation among U.S. lawmakers.

Potential Changes in Expat Taxation Under a Trump Administration

The potential re-election of Donald Trump in the 2024 presidential election may have significant implications for U.S. expatriates, particularly concerning citizenship-based taxation. This taxation system requires all U.S. citizens to pay taxes on their worldwide income regardless of where they reside. Should Trump secure a second term, various scenarios could unfold regarding expatriate taxation that warrant consideration.

One possible outcome is the easing of current regulations. Trump’s administration has previously signaled a preference for reducing bureaucratic burdens. If a similar approach is adopted in 2024, expatriates could benefit from simplified tax reporting requirements and a potential reduction in compliance costs. This might provide financial relief to many U.S. citizens residing abroad, making it easier for them to navigate their tax obligations.

Alternatively, the administration could maintain the status quo, which has existed under previous administrations. In this scenario, expatriates would continue to face the existing complexities associated with citizenship-based taxation, including stringent reporting requirements and potential penalties for non-compliance. This stability could bring a sense of predictability for expatriates but may not address the ongoing challenges they face in managing their tax responsibilities.

Another, perhaps more concerning, possibility involves the introduction of stricter compliance standards. If Trump’s administration were to prioritize tax enforcement, expatriates could encounter increased scrutiny regarding their financial dealings. This could include more rigorous audits and enforcement actions against perceived non-compliance, ultimately complicating expatriates’ financial lives and increasing the fear of penalties and fines.

Overall, the potential changes in expatriate taxation under a Trump administration are multifaceted, with different scenarios leading to varied impacts on U.S. citizens abroad. Expatriates must remain vigilant and proactive in understanding these implications as the 2024 election approaches.

The Impact on Expatriate Communities and Individuals

The possibility of Donald Trump winning the 2024 presidential election raises significant concerns for U.S. expatriates, particularly regarding tax policy changes that could emerge under his administration. One of the foremost implications of such changes would likely be on citizenship-based taxation, a system in which the U.S. taxes its citizens on their worldwide income regardless of their residency. This policy often stirs considerable debate among Americans living abroad, as they must navigate tax obligations in both their host country and the United States.

Financially, expatriates could face heightened burdens if tax policies shift towards stricter compliance requirements. Changes may also lead to increased penalties for U.S. citizens who fail to report foreign accounts or income accurately. Such financial implications could compel some expatriates to reconsider their residency choices, weighing the benefits of living abroad against the challenging tax landscape. The emotional toll of this scrutiny should not be overlooked; the anxiety surrounding compliance can impact the overall well-being of these individuals, many of whom already deal with the complexities of living outside their home country.

Furthermore, these changes could significantly affect the decision-making processes for Americans abroad, particularly when considering dual citizenship or potential repatriation. For many, the allure of retaining their American citizenship is fraught with complications, especially when weighed against the desire for greater simplicity in taxation. Should tax policies become overwhelmingly burdensome, some expatriates may opt to renounce their U.S. citizenship, while others may choose to return home, altering the dynamic of expatriate communities and crisscrossing borders.

In light of the implications stemming from Trump’s potential policy adjustments, the U.S. expatriate community faces a crucial crossroads, with financial, emotional, and existential considerations all at play.

Reactions from Expat Advocacy Groups and Analysts

The prospect of a potential Donald Trump victory in the 2024 elections has sparked considerable discourse among U.S. expatriate advocacy groups and political analysts. Many of these organizations, which focus on the rights and economic circumstances of U.S. citizens living abroad, have been vocal about their concerns regarding citizenship-based taxation policies. Such policies obligate expatriates to pay taxes on their global income, a system that many argue places an undue burden on individuals who may have limited ties to the United States.

Several advocacy groups, like Americans Overseas, have issued statements reinforcing their apprehensions about a Trump administration’s approach to taxation and regulatory frameworks. They argue that a return to power for Trump could exacerbate existing issues related to the Foreign Account Tax Compliance Act (FATCA) and other compliance measures, which they contend disproportionately affect expatriates. Analysts have highlighted that a potential rollback or modification of existing agreements and treaties could further complicate financial reporting requirements for U.S. expatriates living in countries that do not share tax information seamlessly with the U.S.

Furthermore, numerous studies and articles published in renowned financial journals have explored the expectations surrounding a Trump-led response to tax policies that impact expatriates. Many analysts forecast that a Trump presidency could initially maintain the status quo. However, they express concerns that future changes related to tax incentives or penalties might emerge, affecting how expatriates manage their financial affairs. These sentiments underscore a broader uncertainty surrounding the implications for U.S. citizens living abroad, especially in light of rising international tensions and evolving economic landscapes.

In essence, as advocacy groups and analysts navigate the complexities of potential policy shifts, they remain committed to advocating for the rights of U.S. expatriates. Their insights serve as critical voices in discussions surrounding citizenship-based taxation and the realities faced by American citizens beyond U.S. borders.

Legal and Compliance Considerations for Expatriates

As U.S. expatriates navigate the evolving political landscape, particularly in light of potential policy shifts resulting from Trump’s 2024 election win, it is imperative for them to remain informed about legal implications regarding tax compliance. U.S. citizens residing abroad are subject to citizenship-based taxation, meaning they are obligated to report and pay U.S. taxes on their worldwide income, irrespective of their residency status. This unique approach necessitates diligent adherence to tax filing requirements, which could become increasingly complicated depending on anticipated changes in tax policies.

One of the primary compliance issues that expatriates may encounter involves the timely filing of required forms, such as the Foreign Bank Account Report (FBAR) and Form 8938, which discloses foreign financial assets. Failure to comply with these regulations can result in significant penalties, further emphasizing the need for vigilance in tax matters. Moreover, changes in tax treaties between the U.S. and other countries can greatly influence an expat’s tax obligations. Adjustments to these agreements could lead to alterations in how taxes are applied, potentially increasing or decreasing an expatriate’s overall tax liability and compliance burden.

Additionally, U.S. citizens should be aware of potential legal repercussions stemming from tax non-compliance. The IRS’s increasing focus on enforcing tax laws for expatriates has sharpened awareness of the risks associated with not adhering to filing requirements. Expats may also face double taxation issues if the new administration opts for policy changes that affect bilateral tax agreements. Understanding these dimensions is crucial for U.S. citizens abroad, as being proactive in their tax compliance can mitigate risks associated with legal challenges and financial penalties as they adapt to any emerging changes stemming from the political environment.

How Expatriates Can Prepare for Future Uncertainties

As the possibility of a Trump-led administration looms in 2024, expatriates must adopt proactive measures to safeguard their financial well-being and ensure compliance with potential legislative changes. The evolving political climate in the United States, particularly regarding issues such as taxation and citizenship, warrants thorough preparations on the part of U.S. citizens living abroad.

First and foremost, expatriates should prioritize comprehensive financial planning. This involves assessing their current financial situation and considering adjustments according to anticipated tax policy shifts. Engaging with a financial advisor who specializes in expatriate tax matters can provide tailored strategies to minimize tax burdens. It is crucial to understand the implications of citizenship-based taxation, which requires U.S. citizens to file tax returns regardless of their residency status. This understanding can help in restructuring assets and investments to optimize tax efficiency.

In addition to financial planning, expatriates should ensure rigorous tax compliance. Staying fully compliant with U.S. tax regulations, including the Foreign Account Tax Compliance Act (FATCA), is critical. It is advisable to keep meticulous records of all foreign income, expenditures, and financial transactions. Taking the initiative to file all requisite forms and deadlines will minimize any potential legal repercussions in the event of policy changes.

Further, staying informed about legislative developments will empower expatriates to navigate uncertainties effectively. Subscribing to reliable news sources, joining expatriate networks, and participating in informational webinars can provide vital insights into the ever-changing political landscape. Being engaged with fellow expatriates can also foster a support system for sharing knowledge and strategies.

Ultimately, by focusing on sound financial planning, ensuring tax compliance, and remaining vigilant about legislative changes, expatriates can better equip themselves to face the potential uncertainties that may arise from a Trump presidency. Through these measures, they can aim to protect their interests and maintain stability in their expatriate lives.

Conclusion: The Path Forward for U.S. Expatriates

As we reflect on the potential implications of a Trump victory in the 2024 election for U.S. expatriates and the framework of citizenship-based taxation, it becomes apparent that significant shifts may be on the horizon. The administration’s previous approach to taxation, particularly concerning those living abroad, suggests that expatriates could face renewed scrutiny regarding their tax obligations. The prospect of tightened regulations and enforcement could compel expatriates to reassess their tax strategies, ensuring compliance while attempting to mitigate financial liabilities.

The intertwining of political decisions and tax policies means that U.S. expatriates must remain vigilant. Heightened interest in citizenship renunciation, coupled with the real concerns surrounding double taxation and the complexities of international tax treaties, may see more individuals weighing the pros and cons of maintaining U.S. citizenship. It is crucial for expatriates to stay informed about policy changes, as these changes can greatly affect personal and financial decisions.

Moreover, with an unpredictable political landscape, U.S. citizens living abroad should actively engage with advocacy groups that focus on expatriate rights. Participating in discussions, contributing to petitions, and supporting reforms that aim to alleviate the burdens of citizenship-based taxation can empower expatriates. Such initiatives ensure their voices are heard in the policy-making processes that affect their daily lives.

In conclusion, the implications of a Trump 2024 win for U.S. expatriates extend beyond immediate tax concerns; they touch upon broader issues of representation and rights. As changes unfold, it becomes essential for expatriates to remain proactive, not only in understanding their tax obligations but also in shaping policies that contribute positively to their status and welfare abroad.